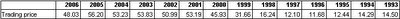

Assuming if an investor bought Walmart in 1993 at USD14.5, and he is a disciplined investor who held till today, he would have gained 4 times his principle. At USD48 today, his annual compounded return excluding dividend is 11%. However, I dare to bet that majority of the investors would not have the discipline and would have been very active in the first 5 years by not holding on to what they have bought in 1993. Most people cannot stand what the market tells them about the price even if the market at large is incorrect at that point in time.

You can see that from 1993 to 1997, the share price was driven down to USD12.10. Most investors would not have stayed so long. Instead they would just lock in on their losses and hop onto another lane which they think can fast-track them forward.

From 1998 onwards, the share price begins to rise to a peak of about USD53 in the early 00s. At this price, the valuations at then would open the eyes of most value investors, the P/E ranged from 32 to 39, price/book were from 6 to 8 times. However, there are some investors who are so greedy where they will hang on and hoping for the price to increase yet further. In fact, some of such investors are also value investors. I find that there are some investors who practice value investing on the buy side, but they become momentum investors when they sell, saying they'll wait for the market to tell them when it's the right time to sell. Personally, I disagree with such investors who practice value investing on the buy side but lost their way on the sell side. That’s bonkers and greed to me. Just like how interest rates and bond prices interact, in aggregate, sanity and greed moves in opposite direction as returns on capital. There is a very valuable lesson here: "In life, we must learn when to let go even if you have a much-loved card in hand."

Of course, you may mentally argue that it is always "all-so-easy" to think back on hindsight. But in truth, the history always teaches us the best lessons. Yet as always, history is a poor teacher and investors are a poor bunch of students.

Instead of looking through the windshield, there are also a bunch of investors who focused into the rear mirror too much. From 1993 to 1997, the stock price went from USD14.5 to USD12.1. Investors then were probably looking and projecting backwards, feeling discouraged about Walmart. This is what Mr. Buffett pointed out in late 90s for the stock market in 1982 as a whole: “Investors projected out into the future what they were seeing.” Then there were some investors who probably bought high at USD14.5 and with the stock price not going anywhere for so long, they decided to get out of the game. And as is so typical, the symptom of a cat who once sat on a hot stove will never sit on the stove again, whether hot or cold.

The major lesson here is the more you are active, the more you lose out - both on your capital and also on commissions paid to intermediaries - for the general investors at large. Unless an investor knows exactly what he is buying, he is bound to lose if he begins to chase the prices.

By the way, I am not saying that the valuations of Walmart were of good values during the period between 1993 to early 2000s except in year 1996 and 1997. In fact, I’ll not have touched the stocks then. What I am presenting is just a simple case to represent many other situations where the business is a good one but the price were not great at certain time and then it become great after some time. But then those who bought high paid a high price but learnt no lesson in preventing a similar case again. And when the price became undervalued, they lost all their patience and they would have sold off before they got a chance to make some profits – as was mentioned earlier, 1996 and 1997 were the years when valuations got reasonable.

*Note: All stock prices are exclusive of dividends and adjusted for all stock split.

5 comments:

Am I right to say that you are preaching the buy-and-hold strategy and "Riding out the storm"? As long valuations are good and it's a business that's understood and would work for next five years.

That's the thing that confused me. Cos Buffett also said before "Not losing money is more important than making money"

So why the contradiction? Isn't it better to "buy low, sell high"?

Hi Fishman, for Buffett, he is almost a buy and hold investor in my opinion. For the individual, it really depends. I am neither preaching or disregarding the buy and hold strategy.

Most important is to be able to value the company correctly in my opinion. Even if a person don't know how to value and he bought a great business at a lousy price, as in this case, it was a lousy price for Walmart in 1993 to 2002 or so, except for 96 and 97. But knowing that Walmart is a great company and having the capability to generate cashflow and good dividends, this overpayment of price will sooner or later be made up. The stock price would then make up and slowly show a positive return in time.

However, on the contrary, if the business is a lousy business, whose earnings is always on the decline or operate in an environment where they got no competitive edge, then buy and hold don't makes sense because the share price will not address to a positive level if earnings does not flows in.

Riding out the storm must be understood with some knowledge. It must not be taken as a whole just like that. You can ride out of a storm if you know the value of it and what it is producing.

Yes, protecting your principal is 1000% more important than risking it. Thus, if you did your studies, you would not even have encountered such cases where you will even consider buying Walmart in year 1993 to early 2000 except in year 1996 and 97.

It is definitely great to buy low and sell high. But the problem here is defining what is a low price. If you use charts to decide, I think that will cause many casualties.

I agree with you that valuation of a company correctly is important. But how does one goes about doing it?

8percentpa pointed out the inefficiency of using SWOT ananlysis. He advocate a system or framework to do that.

With all this talk about valuation, I really wonder what is and how does one do it!

The easiest way is the concept of margin of safety whereby you purchase a stock lower than what it is worth on its financial statements.

Having said that, it is not the best method in valuation although it is good enough. Frankly, valuation is a concept where you need to read up on its fundamentals. And the fundamentals that I refers to is Benjamin Graham ideas. Then of course, you must be able to agree with his basic ideas and be able to make sense out of it to cater to how you select a business.

Someone once said: "The true test of a book is the influence they have upon the lives and conduct of their readers."

Frankly, after having the basics, you need to read up alot on investment to be aware of how things can be in the future, are now presently, and were in the past.

It's a journey where a person must have the patience and discipline to stay focus, be interested and curious to always learn and improve, and also acknowledge your own shortcoming and seek ways to improve.

Firstly, for anyone without much fundamentals, I suggest one to read The Intelligent Investor, from there, you get some ideas, and then you move on to valuations. For valuations, you can get The interpretation of the Financial Statements from Ben Graham as well. It gives you some basic knowledge on how to read financial statements. You can never value a business if you can't understand how to read a financial statement properly.

Thanks for your advice, I'll look out for these books for sure!

Post a Comment