Let’s see why it is a mistake. At age 55 – which is 28 years later – the total sum ($503,000) which is saved by then does not have the same value compared to the day you started out saving. Thus, the next question to ask is “what is the present value of the $503,000 worth at today’s value?” If you apply an average inflation rate of 2% yearly and discount the sum of $503,000 back to today, it is worth roughly $295,000. In other words, you have about $295,000, at today's value, to spend for the rest of the 15 years from age 56 to 70. At today’s value, it means you can afford to spend about $1640 per month with this amount. If you are a single and live in a bare minimum house, it should be enough to last till the age of 70. Then when you hit your retirement age, you must still maintain your discipline in controlling your yearly spending to about $34K at age 56, $34.9K at age 57, $35.6K at 58 and so on. The yearly spending will increase by about 2% yearly to cater for inflation and ultimately, at age 70, your yearly spending will be about $45.1K. However, to not, there is no difference in value between the amount of $45.1K at age 70 or $34K at age 56 because it is eaten up by inflation which is assumed to be at an average of 2%. All these yearly spending are equal to a present value of today at about $19.6K. So if at the age of 55 and if you decide to lose your discipline and forget to continue to put in a higher yielding sort of risk-free interest investments, the amount will not last till the age of 70.

"It's (Value investing) like an inoculation. If it doesn't grab a person right away, I find that you can talk to him for years and show him records, and it doesn't make any difference. They just don't seem able to grasp the concept, simple as it is." - Seth Klarman

Monday, October 30, 2006

Is saving a thousand monthly enough?

Let’s see why it is a mistake. At age 55 – which is 28 years later – the total sum ($503,000) which is saved by then does not have the same value compared to the day you started out saving. Thus, the next question to ask is “what is the present value of the $503,000 worth at today’s value?” If you apply an average inflation rate of 2% yearly and discount the sum of $503,000 back to today, it is worth roughly $295,000. In other words, you have about $295,000, at today's value, to spend for the rest of the 15 years from age 56 to 70. At today’s value, it means you can afford to spend about $1640 per month with this amount. If you are a single and live in a bare minimum house, it should be enough to last till the age of 70. Then when you hit your retirement age, you must still maintain your discipline in controlling your yearly spending to about $34K at age 56, $34.9K at age 57, $35.6K at 58 and so on. The yearly spending will increase by about 2% yearly to cater for inflation and ultimately, at age 70, your yearly spending will be about $45.1K. However, to not, there is no difference in value between the amount of $45.1K at age 70 or $34K at age 56 because it is eaten up by inflation which is assumed to be at an average of 2%. All these yearly spending are equal to a present value of today at about $19.6K. So if at the age of 55 and if you decide to lose your discipline and forget to continue to put in a higher yielding sort of risk-free interest investments, the amount will not last till the age of 70.

EPS, NAV and EBITDA

Wednesday, October 25, 2006

Intelligent investing is like farming

Tuesday, October 24, 2006

Lessons from American's best business leader

Sunday, October 22, 2006

Cost of capital

Saturday, October 21, 2006

Success by means of short-cuts?

Thursday, October 19, 2006

Belts and suspenders approach

Wednesday, October 18, 2006

Secrets to greatness

Tuesday, October 17, 2006

Business and investing quote of wisdom of the week

Monday, October 16, 2006

When wishing beats investing

Sunday, October 15, 2006

From peddling computers to alternative investments

In business school theory, companies give out stock options in order to ensure employee loyalty and retain top talent - making them part of the family where they hold a stake in the business and thus feel more attached to it. Moreover, while receiving options, Deal was also selling his Deal stock - some 8 million shares in 1998 alone. But why was he, wearing his founder's hat, selling stock while in his managerial garb he sucks up so many options?

In fact, 1998 was a good year for Michael Deal to begin giving serious thoughts to diversification of this holding. A year earlier, Deal's shares had led the S&P 500, gaining 216%, and in '98, Deal once again ran at the head of the pack, gaining 248%. But this would be the stock's golden year. From the end of '98 through to spring of 2000, Deal shares would rise only 58% and then plummet. By the end of 2000, they had lost 70% of their value. In the summer of '03, Deal still traded below its Dec '98 high.

By Sep of '98, worldwide computer sales continued to climb, but prices were falling. It is due to saturation of the market. Nevertheless, Deal's shares were changing hands at 67 times the previous year earnings and 49 times book value.

Meanwhile, in order to try to offset the cost of buying back its shares, Deal decided to gamble on its own stock. In an effort to make buyback less expensive, the company decided to use derivatives options that gave them the right to purchase Deal shares at a preset price for a defined period of time. They began buying call options. In call options, it gives the holder of the options the right, but not an obligation, to buy a share at a preset price over a predefined period of time. If the stock continued to climb, that preset price would wind up being lower than the actual market price which they would otherwise have to pay if they are to purchase it through the normal market channel.

Deal's foray into the options market did not stop there. To pay for the call options, the company began selling "put" options - an option which gives holders the right to sell the share to the option's writer - on its stock. The "puts" gave the the buyer the right to sell the stock back to Deal at a preset price over a specific period of time. If the share price fell during that time, the investor who bought the "puts" would win the bet, but if the share continued to surge, the revenues the company raised by selling the puts would become pure profit. This profit will then be used to pay the call options at the strike price of the call options. For a while, the strategy paid off. In one quarter, Deal made more by selling options than by peddling computers.

But once Deal's share price began to plummet, the gamble backfired. In the fiscal year ending Feb 1, 2001, Deal paid an average of more than $43 for the roughly 68 million shares that it bought back that year. Meanwhile its shares were paddling on the open market at an average of $25. Deal's problem did not end there: "The company eventually must buy 51 million more share at $45 - again, well above Deal's current price - through 2004," Barron's reported in 2002. Moreover, a built-in "trigger" provision requires that if Deal drops to $8, the box maker has to settle up all the puts. Deal would have to spend $2.3 billion to cover this: it had $3.6 billion in cash at fiscal 2002's end.

Investors who bought Deal stock thought they were investing in a computer company, not a hedge fund. But unbeknownst to most shareholders, Deal had temporarily turned itself into a company that specialized in high finance - and high risk. Because Deal had gotten involved in the derivatives game, the shares it bought that year cost an extra $1.25 billion - a number that slightly exceeded Deal's net income for the entire year. Under accounting rules then, Deal was not required to show the cost in its financial statements.

Saturday, October 14, 2006

Fundamental law in investing

Definition of Call and Put options (Part 2)

Thursday, October 12, 2006

Definition of Call and Put options

Wednesday, October 11, 2006

Luck versus skill

- Luck, randonness, probability, belief, conjection, theory, forecast, lucky idiot, survivorship bias, volatility, noise, induction.

- Skills, non-randomness, certainty, knowledge, certitude, reality, prophecy, skilled investor, market outperformance, returns, signal, deduction.

Tuesday, October 10, 2006

Business and investing quote of wisdom of the week

Monday, October 09, 2006

Fallacy of investor's inability to stay still

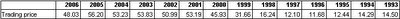

Assuming if an investor bought Walmart in 1993 at USD14.5, and he is a disciplined investor who held till today, he would have gained 4 times his principle. At USD48 today, his annual compounded return excluding dividend is 11%. However, I dare to bet that majority of the investors would not have the discipline and would have been very active in the first 5 years by not holding on to what they have bought in 1993. Most people cannot stand what the market tells them about the price even if the market at large is incorrect at that point in time.

You can see that from 1993 to 1997, the share price was driven down to USD12.10. Most investors would not have stayed so long. Instead they would just lock in on their losses and hop onto another lane which they think can fast-track them forward.

From 1998 onwards, the share price begins to rise to a peak of about USD53 in the early 00s. At this price, the valuations at then would open the eyes of most value investors, the P/E ranged from 32 to 39, price/book were from 6 to 8 times. However, there are some investors who are so greedy where they will hang on and hoping for the price to increase yet further. In fact, some of such investors are also value investors. I find that there are some investors who practice value investing on the buy side, but they become momentum investors when they sell, saying they'll wait for the market to tell them when it's the right time to sell. Personally, I disagree with such investors who practice value investing on the buy side but lost their way on the sell side. That’s bonkers and greed to me. Just like how interest rates and bond prices interact, in aggregate, sanity and greed moves in opposite direction as returns on capital. There is a very valuable lesson here: "In life, we must learn when to let go even if you have a much-loved card in hand."

Of course, you may mentally argue that it is always "all-so-easy" to think back on hindsight. But in truth, the history always teaches us the best lessons. Yet as always, history is a poor teacher and investors are a poor bunch of students.

Instead of looking through the windshield, there are also a bunch of investors who focused into the rear mirror too much. From 1993 to 1997, the stock price went from USD14.5 to USD12.1. Investors then were probably looking and projecting backwards, feeling discouraged about Walmart. This is what Mr. Buffett pointed out in late 90s for the stock market in 1982 as a whole: “Investors projected out into the future what they were seeing.” Then there were some investors who probably bought high at USD14.5 and with the stock price not going anywhere for so long, they decided to get out of the game. And as is so typical, the symptom of a cat who once sat on a hot stove will never sit on the stove again, whether hot or cold.

The major lesson here is the more you are active, the more you lose out - both on your capital and also on commissions paid to intermediaries - for the general investors at large. Unless an investor knows exactly what he is buying, he is bound to lose if he begins to chase the prices.

By the way, I am not saying that the valuations of Walmart were of good values during the period between 1993 to early 2000s except in year 1996 and 1997. In fact, I’ll not have touched the stocks then. What I am presenting is just a simple case to represent many other situations where the business is a good one but the price were not great at certain time and then it become great after some time. But then those who bought high paid a high price but learnt no lesson in preventing a similar case again. And when the price became undervalued, they lost all their patience and they would have sold off before they got a chance to make some profits – as was mentioned earlier, 1996 and 1997 were the years when valuations got reasonable.

*Note: All stock prices are exclusive of dividends and adjusted for all stock split.

Sunday, October 08, 2006

Defining "Investing" and the correlationship of Interest rate and Stock prices (Part two)

Defining "Investing" and the correlationship of Interest rate and Stock prices (Part one)

How is it possible to forecast the long run if you cannot predict the short run?

Saturday, October 07, 2006

Does this article makes sense?

Importance of a stable and honest government

********************************************************

By now, you should know while you were asleep last night, a coup was conducted in the heart of TH. Moving from stability to overnight chaos to an uncertain future. What took 14 years to build took a day to destroy - actually it took a mere 2 years or less to turn from stability to chaos. So much from a great future to a bleak one almost overnight.

Anyway what I'm trying to say is many people are not appreciative of many things, especially on the importance of someone who is doing a great job in keeping growth and stability. Keeping in mind no system or people are perfect, it is thus important to know what will be the best option in life by not asking for the sky.

At least in where we are staying, we have probably the best governing party anywhere on earth, beating the US or any democratic country though the bigger countries have a different set of playing field.

When things like political instability happens, the people who gets affected the most are the ordinary folks - those working class folks. For the smart and able people, it doesn't affect them much though probably they get by with a little lesser but they don't get squeeze out. But if you think about it, political instability cannot happens just with the vote of the important few, it takes the ground to move them. So most likely, it is the ordinary folks who are not happy that gives an opportunity for the opposition to revolt. For people who are lazy, always complaining and always expect others to hand them things, any chance like that to happen, they definitely will not be on the ruling party side. But ultimately the one who suffers the most will be people like those who keep complaining. Because the very fact is the ones who need the most support or help from a good government are the ordinary folks who are not very able to make things happen by themselves. Take for example, the recent generous give-outs by our government, who needs this the most? It is always the ordinary folks. Where does this money comes from? It is from the past performance of the investment done by the government body on behalf of the people with the people money. People complain about government keeping all their money. Frankly, I whole-heartedly support this system. Without this, if the government don’t set aside this sum of money and instead give all back to the people, a large majority will not be able to handle or keep their money in their pocket, not to mention about growing the fund. This is human nature in large part because of the temptation to use it. Assuming all money is given back to the population, I am sure most people will not have the discipline to keep the money for the future. So they will most likely spend a chunk of it and then when they get into trouble, they expect more from the government. By then, if the population really needs financial help from the nation, the nation will not have a safety net to draw on. They will have to find ways to help solve this problem. Most likely, they will increase taxes, both from the businesses and the individuals who are the high earners. In the end, when taxes are more, businesses will chose not to operate here, it drives away potential businesses too, then the highly capable people will also feel being marginalized and probably look elsewhere with it benefits them more.

In any good system, it is appropriate to acknowledge "an ounce of prevention is worth a pound of cure.". Lacking this simple idea, even if the system can do great for a few years while sweeping the negativities beneath the surface, and when judgement day comes, a pin always lays in wait for any past decisions which were not sound. When the pin meets the bubble, no subsequent brillance can undo the damage.

Another thing, a lot of people always think that life is never fair. Well, truly, it is never fair in life. What can be fair is how you make things happen. And also, if you think about it, the moment you are born in this world, it is not fair because of the fact that people are given a different hand based on where they are born, not their ability to survive. We being born in Singapore are a lucky bunch, given a great hand as a headstart. If you were born in India, Africa or China, you’d be fighting tooth and nails over the basic needs for survivor. In fact, to be in SG, you are plain lucky, only 4 million out of billions can be in SG. So what's the probability? Then if things are on a level playing field, I'm pretty sure the majority of Singaporeans are of ordinary ability compared to the billions in India or China. So if you live there, you'll have a hell of a time. In fact, I think many young people here are extremely ignorant, they do not know much about what is happening in the region or in the world. Most will be able to identify with Brad Pitt, Paris Hilton, Kobe Bryant, David Beckham more than they can identify Susilo Bambang Yudhoyono, Gloria Arroyo, Shinzo Abe or Ban Ki Moon. But I can vouch that many of the Mainland Chinese are so much smarter and streetwise in terms of business and world knowledge even though some of them may actually even be so-called less educated than many of us. Just a few days back, my friend ask me what is S.A.R, he thought it refers to SARS, it's pathetic that our knowledge is really that limited. And if China really prosper to the same level as us, they thoroughly deserve the honor.

Not that I am a pro government supporter through and through. I'm a staunch supporter for what they had done for the good of the majority. Nobody on earth can caters to the need of everyone, if someone can do that, that fellow has got no principle because the system will be sway left to right and back all the time.

Friday, October 06, 2006

Can there be more lawyers than people in New York?

Between Dec 1899 to Dec 1999, the Dow went from 65.73 to 11,497 representing a compounded yearly increase of 5.3%. In aggregate, the return on stocks can never be more than what a business can churns out in aggregate. No doubt some people can invest better than some others but in aggregate, the return can never be more than 5.3% in stock investing for all the investors combined. Those who perform better than 5.3% are those who took home more from the same piece of pie at the expense of those who perform less than 5.3%. Moreover, in reality, investors as a whole cannot even hope to match this aggregate (5.3%) that a business earns. This is because in stock investing, there are intermediaries where a cut is paid for and all of these cuts are part of the aggregate that the business produces. In other words, in stock investing, it is wrong to assume that all the profits will go to the investors' pocket, part of it (a pretty substantial ratio) goes into the pockets of those who facilitate the trade.

Certainly, there are many times when the value of the subset far exceeds the value of the product. Those are the moments where logical math encounters a problem that will be addressed through time. So what is driving this mistake? It is none other than emotions. When emotions come into play, it deviates the facts that would otherwise be logical. What would then brings the facts back to reality? A pin will always lays in wait for every emotional bubble when people realize they have drifted too far off. Market is like a pendulum swinging from unsustainable emotions or optimism to unjustified emotions or pessimism, the centre between these two extremes is the efficient and logical point. The pendulum will never remains stagnant at a single point. Firstly, Wall Street will never allows it to be so. When there is no story, there is no dough. Somehow a story must always be created to generate interest to swing the pendulum to the side which is normally not to the general investor's interest.

Are we being fooled by randomness?

Suppose in a national coin-flipping contest there're 4 million contestants and each of them will all wager a dollar each. Each morning, they all call the flip of a coin. If they call correctly, they win a dollar from those who called wrong. Each day the losers drop out, and on the subsequent day the stakes build as all previous earnings are put on the line again. After ten flips, there'll be approximately 3900 people in Singapore who have called their flips correctly for 10 times in a row. They each would have won slightly over $1000.

Now this group of winners will perhaps start to get a little puffed up on what happened, human nature being what it is. They may try to be humble, but at some parties, they will occasionally admit what their technique is, and what marvelous insights they bring to the field of flipping.

Now assuming that the winners continue to play the game for another 10 days, we will have roughly 4 people surviving the game. Each will have a little over a million dollars. After 20 days of flipping, a dollar becomes a million. By then, this group will probably have lost their heads. They may write books on "How I turned a dollar into a million in 20 days working 30 seconds a day?" Worst yet, they may start jetting around the world to give seminar taking in say $2000 per audience on efficient coin-flipping and tackling skeptical people with "If it can't be done, why are there 4 of us?"

But then this group of skeptics may be rude enough to bring up the fact that if 4 million orangutans had engaged in a similar exercise, the outcome would be still much the same - 4 egotistical orangutans with 20 straight winning flips.

From the above what I am saying is many successful events may or may not be due to randomness. We must never mistake success as randomness or vice versa. Sometimes we mistake randomness as success and success as randomness. In identifying if things are due to randomness, think about this, 1) if you had taken 4 million orangutans distributed roughly as the population of Singapore; b) if 4 winners were left after 20 flips; and c) if you found 3 came from a particular zoo somewhere, you would be pretty sure you were on something. So you would probably go out and ask what the zookeeper feeds them, whether they had special exercises and so on. So, if you found any really extraordinary concentrations of success, you might want to see if you could identify concentrations of unusual characteristics that might otherwise be casual factors. Almost certainly, if a case of concentration of characteristics in a particular group who are left standing, this is not due to randomness. d) if all 4 winners turns up from different zoo with no particular set of knowledge, these orangutans can still turn their achievement attributed to randomness to fooling others into doing the same thing while getting paid for in seminars. Those others who subscribe to these random winners may get fooled by these 4 orangutans' random success as real workable means to achieving the same kind of success. By the time they realize the trick of randomness driving the 4 orangutans' success, they will have learned nothing but luck and perhaps some painful lesson which costs a bomb. I believe some of these orangutans lay in the classified section.