What

a dramatic last three trading days to close the first half of the

year on a high note! S&P500 is up 8.3% for the first half, or

over 16% annually - which by any measure is a great result - double

the historical growth rate. Stock prices have been steadily ascending

since October 2011, boosted by a whiff of hopeful recovery in the

U.S economy, a seemingly claim state amidst the sovereign-debt storm

in the E.U., merrily cheered on by central bankers with near-zero

interest rate and hoping for further easing.

Here

is an oxymoron: The job of an investor or money manager is not to

make money but to manage risk because once you take care of the risk,

you take care of the rest. One of the most important job in managing

risk is to measure the temperature of the economy and know where we

stand. At the moment, it is unwise to be fully invested unless one

can find something that is totally uncorrelated to the market.

However, even in a expensive market, there're still value buys on a

bottom-up basis because the market is never fully efficient – just

a matter of degree.

If

you are an individual in debt, what would you do to solve your debt

problem? Would you take on more debt to pay your old debt? No, you would not. Would taking on more debt to pay your old debt solve your problem? No, it does not. The only way to solve

your problem is to cut your expenses and pay down your debt. Or you

can chose to default and break your obligations which were granted on

the basis of trust in your ability and goodwill to repay the loans.

Essentially, those people in debt need to stop spending money that

they do not have. So why should it be any different for a sovereign

country? The solution to too much debt is not more debt.

Sooner or later, something have to give and people start facing the

ugly truth. The highly-in-debt country may just chose to default on

its obligations, either directly or indirectly. By indirect manner, a

country can print more paper currency to pay the interest which makes

the currency worth-less if the debt are issued in their own currency.

A direct or outright default happens when a country simply stop

making payments for their obligations – and there's no recourse to

claiming from a sovereign country: you can sue a company for

defaulting and claim its assets in court but for a sovereign country,

how do you sue for a country's assets? Bill Gross and Jim Rogers are

two proponents who question the solution of using more debt to solve

a debt problem. All these look like a band-aid solution for which

every time the policy makers gave such a solution, the market jumps

on the hope of it being a panacea but after a while, real questions

set in and bring the market to where it was before. How many times

have this type of scenario been played over the past year or so?

Here

are some recent quotes from Bill Gross:

- “Lots of money being printed but very little wealth. Wealth comes from innovation and elbow grease not higher asset prices.”

- “Don’t be fooled, central bank credit creation increases asset prices but it doesn’t create wealth.”

- “Wealth’s not cre8(a)d w(ith) high(e)r asset prices but w(ith) productiv(i)ty;labor;innovati(o)n. High(e)r asset prices due 2(to) lo(w) inter(e)st rates (a)r(e) fi(ct)ktitIio)us wealth.”

So

the question is what should we do now?

In

an up-market, some investors for “fear” of losing out may be

lulled into pumping more cash into equities. But in an expensive

market (top-down), there's a dearth of compelling cheap businesses

(bottom-up). So is the market now cheap , a value trap, or just

expensive? There are two ways that tells two different stories on the

same topic. By the traditional value method, a snapshot of the S&P500

shows a current multiple of 15x (based on trailing 12-months

earnings), which is not overly expensive in historical terms. But the

Shiller PE which is based on a 10-year moving average of earnings to

smooth out the impact of an economic cycle, shows an expensive

historical 24x.

So

why did the two measures differ so much apart? In a March 2012

article by James Montier of GMO, he noted a compelling point: The two

PE measures are derived from different time perspective. Profit

margins are an important determinant of earnings and Montier gave

mathematical evidence that the divergence of the two measures lie in

the result of profit margins deviating from their long-term normals.

That is to say, profit margin today is at historical high for U.S.

Corporates. In fact, it is abnormally high, hovering almost 2% points

over the last peak since 1952, according to NIPA Flow of Funds data.

Such a margin is unprecedented and has caused earnings to go through the roof, or perhaps “artificially” high. Some of the

margin improvements are achieved through synergy, cost cutting, labor

cost, etc. And there is so much you can do to cut your way to

prosperity. Not only is corporate profits at the highest ever, but wages as a percentage of GDP is at the lowest ever since post-war.

As an example, a small compression in margins can cause a big distortion to stock price, particularly if you purchase at the peak. Nike, which just reported earnings, is off almost 10% for the day when they reported a lower margin (not a lot lower but about 2% lower in gross margin). For those who bought at the peak of $115 thinking that margin cannot be compressed, and extrapolated from the recent past, this is a toxic cocktail. So they learn the old lesson the old way, through their wallets and is down almost 25% in less than three months.

Another

broad measure is taking the total market value as a percentage of

Gross Domestic Product. The broadest index to use is the Wilshire

5000. Using this index, the total market value of Wilshire 5000 as a

percentage of GDP is 106% as at June 30, 2012. There're two ways to

look at it again: if you compare since 1950s, 106% falls on the high

end of the spectrum; but if your vision is tunneled to just the

recent past since 1995, this is on the low end. But extrapolating

from recent past can kill you. The market has historically been

priced at 60-80% of GDP, it is only in recent past, particularly from

the 1995, did the percentage top 90% and above, peaking at over 170%

in March 2000. Here's a graph that speaks a thousand words.

World

Bank also compile their own data. You can find the data in this link:

http://data.worldbank.org/indicator/CM.MKT.LCAP.GD.ZS?page=4.

Unfortunately,

World Bank only have data from 1988 onwards but the trajectory,

whether World Bank or the first graph, are the same. Both also shows

clearly the difference in valuation 1) before 1995 and 2) after 1995.

The year 1995 was the first time in financial history that the U.S

has seen its total market value as a percentage of GDP touches 90%

and ever since, it has averaged well above 90%, except in 2009 when

it fell below 80% just for a moment, and stayed over 90% since. Now

some people may have gotten used to it and argue that 100% is on the

low end of the spectrum for the last 20 years and therefore, the

market is reasonable. Well, only time will tell who is right. For us,

we rather err on the side of caution than to be recklessly bold.

By

locking up the bulk of assets or capital in equities right now is

likely to doom your portfolio to a long-term return rate that is

historically unattractive and that grossly under-compensates you for

the risks assumed. More importantly, having limited cash at a time

when you should be having more means forgoing future opportunities

that are likely to be better than today's. And in a distressed

market, by selling stocks in order to buy other distressed stocks is

no bargain if your stocks are also in distress. The bargain comes

only if you have liquidity at the right time which holds water and

can be used to buy someone else's perceived trash (treasure to the

buyer), and exchange the cash, which in fact is trash at that time

but perceived as treasure by someone else. During the market low of

2009, sellers perceived their stocks as trash (treasure to the buyer)

and sold it in return for cash which they perceived as treasure

(trash to the buyer). The right thing to do then was the other way

round. We have seen this scenario played over and over again.

To

get good return and yet low risk, the best time to be fully invested is when market

is in great turmoil. At this point, potential return far outweigh the

risk assumed. This should be the hallmark of a prudent investor or

money manager. To join the rat-race chasing for return together with

your peers for fear of losing out or for the reason of looking bad is

not prudential. When we start to compare ourselves against peers or

even indices and only focus on comparing, it is easy to get lull into

operating on a relative basis rather than absolute one. Instead, we

must only focus on things that are truly important, especially risk

management. In investing, the only way to make money is absolute, not

relative – as they say “you cannot eat relative.” Perhaps some

people may feel good even if they lose money as long as they lose

less than the market. When they make 50%, you may think they are

delighted but for investors who get lost in relative performance,

they are not. They are likely to feel very terrible. Now, you may

think how can someone who makes 50% feels terrible? Lo and behold,

these relative investors are happy with 50% until they see the market

making 55%.

So

as an investor, you got to decide what you want to be. For us, we

focus on absolute return. To do so, we

follow our core principles as follows:

- We work on patience and maintain discipline by not chasing for return that does not sufficiently compensate for the risk we take - even if our portfolio lags behind the market in the short to medium run.

- We focus on doing what we think are the right things even if it looks wrong in the eyes of others, and not what looks right or relative.

- We do not look to beat the market all the time. We only look to beat the market at the right time, particularly, we aim to significantly outperform the market on a downturn and hope to maintain with, or even underperform the market on an upswing.

- We are dedicated to measuring our performance on a full economic cycle (i.e., a long market cycle that goes through thick and thin) against the market benchmark.

- We do not allow others to tell us what to buy, what to sell, when to buy or when to sell, especially on a baseless manner. Although we pay attention to what they say because it gives us an inkling what the market is doing and if what they are doing is sensible or not, and we position ourselves accordingly.

- We make our own decisions on how we think about the business and the value that is expected from the price we pay or sell. We eat our own cooking. Others who tell us what to do usually do not eat the cooking with us.

- We do not rely on others to measure our performance, we evaluate ourselves by what we say we will do in our core beliefs that will bring us long term performance excellence on an absolute basis.

You may ask what are the right things. It is impossible to clearly lay it all out. We can only say we know it when we see it - just like Judge Potter Stewart when explaining what is hard-core pornography, said: "I know it when I see it."

Armed

with the above, we, as investors, are at the crossroad facing a

fundamental choice on how to reach the final destination – do we go

slow or do we sprint? The first thing to recognize is investing is

akin to running a marathon. If you sprint, you may get ahead of

others at first, but losses your steam pretty darn fast. Thus, pacing

oneself is crucial. Remember, the Aesop's fable, “The tortoise and

the hare,” is just as applicable today as it was back then. And

today is one of those days you do not sprint, instead, keep your

breath and energy, and watch others sprint until they cannot. And

heaven forbids, you might even want to egg others on to sprint.

Despite

all the dramas, many of which unresolved, investors have hardly

balked even as we live in a more interdependent world. There are more

challenges to come in the second half including the “fiscal cliff”

issue. Eventually, something have to give and a band-aid solution

would work no longer. When the day of reckoning arrives, policy

makers can be counted on to do the right thing eventually. But it

will not be good for the securities market in general. That is when

we will be absolutely optimistic for the future: We are neither a

perma-bear nor a perma-bull. It depends on where we are in the

economy. Meanwhile, it is never fun waiting for the time to arrive,

and it is certainly not fun to be fully-invested when the day of

reckoning comes, but it is certainly fun when the day arrives,

provided you have bullets to shoot, so to speak. What dooms a man is

his failure to sit quietly in a room as Blaise Pascal observed all

along, and we are determined not to be such a man.

As

of 30 June 2012, cash as a percentage of assets is about 28% of total

assets, down from 32% at the start of year. We are very reluctant to

go much below this threshold based on current market conditions

unless we can find something really valuable. As we write, we managed

to increase by 4% in cash on the last trading day of the first half.

We will divest more stocks into cash if the market gets more

expensive, hopefully, it will. We are cheering for it although we

have the capacity to allocate into stocks, but we are net-seller in

this market.

Although

we hold a reasonable amount of cash, we have outperformed the major

U.S indices but underperformed the Singapore index. We did not deliberately aim to outperform in this market but our positions generated the returns that allows it to. In an

expensive market, we are satisfied to keep up with, or even

underperform, the market. It is in an upheaval market that provides

us with the best chance to outperform significantly in the safest

manner. In the game of investing, we wait for others to commit

unforced errors. We do not claim to have any special or better skills

than any other market participants. Charles Ellis, long ago,

described this phenomenon in his article, “The Loser's Game:” In

the game of investing, it has long ago turned into a game where folks

with ordinary intelligence can win as long as they wait for others to

commit mistakes. Investing is not a value-adding activity, it is a

zero-sum game: In order for someone to make money, someone else must

make a mistake. When you buy X security, someone else must sell you X

security. In the exchange, you as a buyer think X is likely to make

you money while the one who sells you X thinks it is likely to be a

loser. Who is correct? Someone must be making a mistake, it is either

you or the seller. As they say in Poker, if you do not know who the

patsy is on the table, it is likely to be you. Another word of

caution: in investing, it is relatively simple if you focus on the

right things and keep learning but it is not an easy game. Only a

fool will think it is an easy game.

Another hardly-asked question is how did the portfolio achieve its results. Most of us tend to just focus on the headlines. For example, if you compare the following arbitrary portfolios handled by different managers:

If we are to chose which manager to hand out money to, we will hand our money to Manager B. If there are only two choices - Manager A and C - we will chose C. Over our dead body will we ever chose A.

Another hardly-asked question is how did the portfolio achieve its results. Most of us tend to just focus on the headlines. For example, if you compare the following arbitrary portfolios handled by different managers:

- Portfolio A returns 50% in first half 2012.

- Portfolio B returns 2% in first half.

- Portfolio C returns 2% in first half.

- Portfolio A 50% return was largely achieved by placing a significant portion of assets in a "hot" stock with minimal revenue and has yet to generate any earnings to show for. However, it is "hot" and much pursued after by market participants because of its perceived attractiveness with novel technological capabilities that has the "potential" to grow exponentially.

- Portfolio B is up only 2% and underperformed the major indices by 4-6% because the manager deemed the current state of affair as risky, especially with a dearth of compelling buys. He, thus, allocated, less than 50% into equities, with the rest lock in safe havens like cash or short-term treasuries, while biding for his time.

- Portfolio C underperformed at the same rate as Portfolio B. However, the results for Portfolio C was achieved very differently from B. The manager for Portfolio C is almost fully invested, with only 10% cash or less. However, most of his equities turn out to be duds and most of the securities are not in safe-haven securities like consumer staples or the stable type of stocks. Most are in cyclicals. And it returns 2% versus the major indices return of 6-8%.

If we are to chose which manager to hand out money to, we will hand our money to Manager B. If there are only two choices - Manager A and C - we will chose C. Over our dead body will we ever chose A.

To

end this segment, here is a portion of one of our favorite poems of

all time which happens to capture the essence of successful investing

– “IF” by Rudyard Kipling:

Quote

If

you can keep your head when all about you are losing theirs and

blaming it on you.

If

you can trust yourself when all men doubt you but make allowance for

their doubting too.

If

you can wait and not be tired by waiting, or being lied about, don't

deal in lies, or being hated don't give way to hating, and yet don't

look too good, nor talk too wise.

Unquote

What

have we set out to do at the outset and have we accomplished it?

- Have we been conservative in a seemingly expensive market and be brave in a seemingly chaotic one? Check. Compared to early 2009 to mid 2011 when we were fully invested, we shifted gears starting mid 2011 to more cash, peaking at 35% cash, but has since dropped but we are still rather conservative holding 28% cash. We will increase or decrease depending on how hot or cold the market is, or if we can find cheap buys even if the market is hot.

- Have we been able to resist chasing after returns for the sake of keeping up with the Jones and be satisfied to underperform in an up market and outperform in a down market which is the strategy to long-term outperformance in a full economic cycle? Check. Our portfolio has so far shown the characteristics to underperform when the market takes a huge step forward and outperform when the market takes a huge step back. And over a period of time, we have delivered results that are satisfactory, and so far been absolute. Here are some examples:

- S&P500 is currently flat from the closing of April 2011 of 1363.61 (peak for 2011), while our portfolio is up 3% while maintaining a cash level of 25 to 35% for most of the period.

- S&P500 is currently down 3.3% from the closing of April 2012 of 1408.47 (close to the peak for the first half), while our portfolio is up 1% while maintaining a healthy cash balance of 25 to 28% for the period.

- In an up market, we are likely to underperform the benchmarks but we will not be unhappy, instead we are satisfied although it may be emotionally tough but we understand our goal. For example:

- If measured from market low: From end September 2011 (market low) to now, S&P500 is up 20.4%, while we are up 14.4% while maintaining a cash level of 15 to 32%.

- If measured from the high to the low in 2011: From end April 2011 to end September 2011, S&500 is down 17% while we are down 10%.

The above examples demonstrated, thus far, that we are able to deliver satisfactory results by paying attention to risk. This is achieved by 1) outperforming the market on its way down, and 2) matching or slightly underperforming the market on its way up. We wait for unforced errors and pick up the free lunches - maybe not free but for a dime or significantly less than its intrinsic value. - Did we dig for gems regardless of market's temperature? Check. We will never throw out the baby with the bath water under any conditions. Mastercard and Visa were bought at a valuation that is likely to produce mid-teens return for the medium term even though it reduces our kitty.

- Have we exercised patience, and analyze thoroughly before buying or selling ? Need to work on. We could have been better but we take it as a learning curve. Although we had done reasonably well for most of the stocks that we sold based on what we think it is worth, there is, however, one which we committed an elementary error – Anheuser Busch Inbev. It is not because we feel terrible that the stock has surged to over $79 (we sold at $64.6) but rather for the failure to do a proper analysis when we sold and then learnt later that we left significant value on the table. We do not feel terrible just because a stock surges from the price we sold. Two other stocks that we disposed have also gone up – Starhub (sold at S$3.28) and SIA Engineering (sold at S$3.87) – but these two are likely to be, at best, fully valued. We do not see how Starhub and SIAE earnings can grow at the same pace as how the stock prices suggest, particularly, Starhub because they have run out of tax assets and need to pay tax in cash very soon, but sure, they have better levers than the other telcos which they can pull to increase debt which may benefit shareholders.

We do not expect our current outperformance to

continue if the market gets more expensive by the day. In fact, if it gets

more expensive, we are likely to underperform, probably by a large margin.

Heaven knows how long the market's ascension can last, but one thing for

sure, nothing goes in one direction forever and on a straight path,

the day will come when something -expected or unexpected – that

will knock the breath out. In fact by being more conservative, we

have managed not to lose as much back for what we had laboriously

fought for. From end of April 2011 to end September 2011, the S&P500

lost 17% while our portfolio lost 10%. But we are not as conservative

at that time than we are now. The outcome as demonstrated by the most recent

smaller slump: From end of March 2012 to the 26 June 2012 (3 days

prior to the market surge that ends the first half on a high note),

S&P500 declined by 6.3% while our portfolio declines by 1.2%.

Thankfully,

we have managed to do reasonably well even when the market is not

particularly cheap and probably risky, while able to maintain a

reasonable cash level at 28% of assets, though down from 32% cash at

the start of year. The reduction in cash can be attributed to the

purchases for Mastercard and Visa.

What

are the main drivers for the portfolio first half performance?

- Coca Cola – We took the opportunity to add KO at an average price of about $67. We would not have added more Coca Cola had Pepsico price not been within 3 to 4% percentage less than KO because we do not think it is prudent to reduce cash holding significantly for a stock that is only slightly undervalued. But compared to Pepsico, KO is a better bet if KO is selling for only 3-4% more than PEP. Therefore, to fund the purchase, we reduced our then-significant exposure to Pepsico and bought into Coke. Although, we have since reduced roughly 2/5 of KO. Today, the difference between KO and PEP is about 10%, down from 15% earlier, in favor of KO. And let's not misinterpret this as a technical play or based just on the difference in prices. Rather, it is a comparison of which stock provides a better value if the price of Coke is 3-4% more than Pepsico. At $67 for KO, it is selling at almost the same multiples with PEP at $64-$65 and KO eps growth is brighter than PEP. This was prior to PEP's reduced earnings guidance. In total KO return 14.8% for the first half, and comprised about 13% of the total gain for the portfolio.

- Mastercard and Visa – Stakes were accumulated in January 2012. Return for the two shares is 17.6% since acquisition. This group comprised about 20% of portfolio total gain.

- United Overseas Bank – Up 25.5% for the first half. Makes up 24.4% of portfolio gain. However, the performance is much less stellar if measured from cost, up only 6.6% (although if measured in SGD terms, it is up 10%) since acquisition during second half of 2011.

- Berkshire Class B – Up about 9.2% for the first half. Comprised slightly over 9% of total gain. However, it is up by only 4.3% from cost. Shares were acquired at different times, with two-thirds acquired in May 2011, and the rest acquired in Jan 2011 and earlier.

- Haw Par – Up 17% year to date. Contributed 5% of total portfolio gain.

- Pepsico – Up 6.5% for the remaining shares. However for those shares that were sold, it was sold at a lower price ($65.74) than the price at the start of the year ($66.35), therefore, it lowered the gains for the remaining Pepsi shares.

- Remaining gains came from smaller positions such as DirecTV, Reckitt Benckiser, Becton Dickinson (partially sold), CSX (sold), Anheuser Busch Inbev (sold), Amgen (sold) and some opportunistic stocks like St. Jude Medical, Starhub, SIA Engineering and Baxter which are all sold.

- Opportunistic stocks – St. Jude Medical was acquired for $32.5 in December 2011 and was sold at a gain of 10.5% the next month. Baxter was similarly bought in December 2011 at $48.11 and sold two months later for a gain of over 16.8%. SIA Engineering was acquired in January 2012 for $3.38 and sold in March for a gain of 13.3%. Starhub was bought in January 2012 and sold recently in June 2012, for a gain of 20%. These four opportunistic stocks comprised about 7% of total portfolio gain.

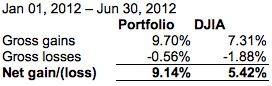

- The above reflects the positions with positive returns. The total return for the above positions produced a gross gain of 9.7% year to date. But this is offset by some positions with losses Net result as shown along with Dow Jones Industrial Average as a comparison:

In

case you are wondering why we did not take S&P500 which is more

broad-base and representative as a comparison: DJIA only consists of

30 stocks and is a price-weighted index. This makes it easier to

calculate than to go through the hassle for S&P500.

- Losers for first half includes:

- Norfolk Southern (-1.4%),

- Western Union (-5.4%),

- Google (-3.6%),

- Celgene (-12%),

- Tesco PLC (-2.1%),

- Singapore Land (-1.8), and

- Molson Coors (-1.6%).

69% of the losses comes from Norfolk Southern, Pepsico (related to the shares sold to fund KO), and Celgene. Of the 3 main loss contributors, we hold a larger position in Norfolk and Pepsi compared to Celgene. Unfortunately, after purchasing at $73, it fell through the roof to a low of $59, and is now $64 and change,. This is mainly because of a delay to gaining new marketing approval for extended use in the E.U for its top selling drug . But at $59 or below, we stand ready to add because we think it has a strong line of current commercial drugs and also a decent pipeline that serves to extend use for existing drugs and also new drugs in trials.

*All

performance mentioned excludes dividend.

Additions

to portfolio:

- Mastercard and Visa

Started

accumulated in January 2012 with an initial allocation of 5.7% of

total assets. Subsequently, added another 4.2% of total assets in

May 2012 when there was a small correction for both stocks. In

total, almost 10% of total assets (based on start of year total

assets) were allocated in these two equities.

Average

price paid - $369 for Mastercard and $105 for Visa. Return since acquisition –

about 17.6% as a group.

Why

Mastercard and Visa? We paid about 16x on a forward 12 months earnings for

both. Medium growth rate for both stocks range from mid to high

teens for earnings per share. Any business with a fairly predictable

revenue stream, defensible business model, growth at well over 10%,

and available for 16x earnings is likely to do well. Historical eps

growth is well above 20% since their IPOs. Foreseeable medium

growth is over 15%.

Now take Mastercard as an example and assume growth slows to 10%, earnings by 2015 would then be $27.4 per share. In order to lose money, the stock must sell below 13.5x in 2015 and growth rate must slow to 10% for us to show a loss. Of course, if such a scenario happens, we will be extremely glad to double, triple or even quadruple our stake for a business that still carries a 10% growth rate and sells for a very reasonable 13.5x earnings.

Now take Mastercard as an example and assume growth slows to 10%, earnings by 2015 would then be $27.4 per share. In order to lose money, the stock must sell below 13.5x in 2015 and growth rate must slow to 10% for us to show a loss. Of course, if such a scenario happens, we will be extremely glad to double, triple or even quadruple our stake for a business that still carries a 10% growth rate and sells for a very reasonable 13.5x earnings.

Otherwise,

in a normal path, assuming an achievable medium per-share-earnings growth of

15%, by 2015, Mastercard would earn at least $40 per share on a

forward 12-months basis. Assuming there is no compression in

multiples from what we pay, at 16x, stock sells for $640, an annual

return of 15%. If multiples increase by 20% and sells for 19.2x,

stock will be worth $768, a return of 20% annually. Conversely, if

multiples compress by 20% (12.8x), stock will be worth $512, an

annual return of 8.5%. In which case at 12.8x multiples, we will

add a lot more, because we view the lagging stock price as if the

stock is brisk-walking at that moment before it picks up steam to

jog and then sprint and ultimately, the full value will be

recognized. So if the stock brisk-walks while the value is

increasing at a faster clip than the stock appreciation suggests, we

will be there to catch more of it.

In

fact, I am late to the game for Mastercard and Visa because I was sucking my thumb for too long and held my trigger at least twice in the

past, particularly, during December of 2010 when both of their

prices plunged due to the Durbin Amendment.

- DirecTV

Comprises

about 3% of total assets. We got familiarize with DTV when Berkshire

announced the hiring of Ted Weschler in mid 2011. We first bought

DTV in September 2011 at $40.99 and then dispose the next month at

$47.2. Then in December 2011, we bought again at $42. And in May

2012, we accumulated a bit more at $45. Average price is $43.4.

Why

did we buy and accumulate more even at a price higher than the

initial price? For one, it is cheap and cash flow is predictable.

The other factor is the stock price has not kept up with the value,

i.e., compression in price-to-earnings and it was pretty sizable

one. Management targets for over $5 eps in 2013. Therefore, at

$43.4, it is less than 9x multiples for a business with highly

predictable cash generating capability.

Return

year to date is 12.5%.

- IBM

Makes

up about 8.5% of total assets. Bought between the range of $178 to

$198, at an average of $188.6. IBM revenue is much more predictable

than what it used to be. IBM, in essence, is very different from the

start of the decade. The transformation, owning to Lou Gerstner, has

been focused on shifting the business to higher value areas of the

market, improving operating leverage and investing in opportunities

to drive growth. IBM operates in four major segments: 1) Global

Services (GS); 2) Software; 3) Systems and Technology (ST); and 4)

Global Financing. Out of the 4 segments, 3 have got annuity-like

characteristics.

“Global

Services” which makes up 56% of total revenue, 44% of pre-tax

income. Approximately 60% of GS revenue is annuity based, coming

primarily from outsourcing and maintenance arrangements.

Software

revenue is approximately two-third annuity based, the remaining 1/3

relates to one-time charge arrangements for charges like license

fees, subscription, etc. Software comprises about 24% of revenue and

47% of pre-tax income.

The

role of Global Financing is to facilitates client's acquisition of

IBM systems, software and services. It is similar to a finance

company except that it has the benefit of both a deep knowledge of

its client base and a clear insight into the products and services

that are being financed. This allows Global Financing to effectively

manage two of the major risks – credit and residue value – that

are normally associated with financing. This segment of business is

very annuity-like and held up well as demonstrated in the table

below.

Global

finance has done well even during the financial turmoil of 2008/9

and has grown strong since.

In

terms of valuation, we paid 14x for 2011 adjusted earnings and 12.6x

for 2012. Management has a detailed roadmap on steering the company

towards achieving goals for both the longer term and also medium.

IBM aims to earn $20 adjusted earnings per share in 2015. If IBM is

priced at 12x 2015 earnings which is cheaper than today and also on

a historical basis, it is worth $240, a return of 6.5% annually. If

it is priced at 14x 2015 earnings, it is worth $280, an annual

return of slightly over 10%. If it is priced at 16x 2015 earnings,

it is worth $320, an annual return of 14%. Of course, if the

earnings surprise on the upside, the return will likely be much

more. Conversely, it can as well surprise on the downside. But IBM

has been conservative in its guidance for a long time ever since

Gerstner's days.

- Norfolk Southern Railway

Norfolk

comprises about 4% of total assets. The stake arises from the sale

of CSX Rail, for which we divested at a net gain of 12.5% and bought

into NSC. However, there isn't much difference economically owning

either CSX or Norfolk unless the price-to-value margin between them

greatly diverge. I'm indifferent to either CSX or Norfolk on their

fundamental business. Both are likely to perform step in step of

each other because both possess almost the same economic

characteristics.

Average

purchase price for Norfolk is about $73, a loss of 1.4% since

purchase. I admit I should have been better in timing the purchases

because right after the purchase, it fell to as low as $64, had I

not gave in to my lack of patience. Having said that, railroads even

at $73 should provide a decent value, though it can be a little more

volatile and cyclical. But overtime, rails are in a good position to

earn more than today in the 5, 10 or 15 years from today. Though in

now to then, there will be aberrations, especially on volume, but

not so much on unit price. In fact, rails have demonstrated their

pricing power as can be seen in the below table for the major

railroads:

The tables clearly demonstrate the strength of all of the rail franchises on either side of the coasts through a full economic cycle. The pricing power held up well even in the face of market distortion in the years 2007 to 2009. Revenue per unit in 2009 is 7.7 to 10% more than 2007 for all the railroads even with unit volume falling 20% from 2007. Moreover, total volume in 2011 was still 10% less than its previous peak in 2006. Volume today is around the same as it is in 2003. One of the “concerns” on railroads, particularly the eastern railroads, was recently directed at the decline in coal volume which is likely to be secular rather than cyclical, as long as coal cannot compete with natural gas as a fuel for energy. Just this week, Rex Tillerson, CEO of Exxon Mobil, sort of admitted his mea culpa in going big into natural gas. However, the decline in the coal franchise (over 40% of total volume) is offset by growth in the overall merchandise businesses, particularly very strong growth in vehicle/car carloads with year to date volume growing in excess of 20%. In the latest weekly traffic report from the Association of American Railroads, the total coal carloads for year to date is down 10.8%, but the decline which started since 2011, is levering off. In the week of 25, coal volume is down only 0.4%. So any future decline in coal is bound to have a much lesser impact to total volume, and may even be accretive to volume if there's an untick. Although utilities are using less coal, coal is not going to go away totally, coal makes up 45% of electric energy sector in the U.S in 2011, down from 49% in 2007. According to an outlook released in January 2012 by EIA, coal is forecasted to generate 39% of all electricity generation over the next 25 years. Others are forecasting even lower - expecting coal to fall to 30% of all U.S electricity generation by 2020. Utilities are the major buyers of coal – buying more than 90% of coal mined in the U.S.

The tables clearly demonstrate the strength of all of the rail franchises on either side of the coasts through a full economic cycle. The pricing power held up well even in the face of market distortion in the years 2007 to 2009. Revenue per unit in 2009 is 7.7 to 10% more than 2007 for all the railroads even with unit volume falling 20% from 2007. Moreover, total volume in 2011 was still 10% less than its previous peak in 2006. Volume today is around the same as it is in 2003. One of the “concerns” on railroads, particularly the eastern railroads, was recently directed at the decline in coal volume which is likely to be secular rather than cyclical, as long as coal cannot compete with natural gas as a fuel for energy. Just this week, Rex Tillerson, CEO of Exxon Mobil, sort of admitted his mea culpa in going big into natural gas. However, the decline in the coal franchise (over 40% of total volume) is offset by growth in the overall merchandise businesses, particularly very strong growth in vehicle/car carloads with year to date volume growing in excess of 20%. In the latest weekly traffic report from the Association of American Railroads, the total coal carloads for year to date is down 10.8%, but the decline which started since 2011, is levering off. In the week of 25, coal volume is down only 0.4%. So any future decline in coal is bound to have a much lesser impact to total volume, and may even be accretive to volume if there's an untick. Although utilities are using less coal, coal is not going to go away totally, coal makes up 45% of electric energy sector in the U.S in 2011, down from 49% in 2007. According to an outlook released in January 2012 by EIA, coal is forecasted to generate 39% of all electricity generation over the next 25 years. Others are forecasting even lower - expecting coal to fall to 30% of all U.S electricity generation by 2020. Utilities are the major buyers of coal – buying more than 90% of coal mined in the U.S.

Rail

volume has not really had much of a tailwind behind its back yet. In

fact, housing and construction is still not far from the the bottom,

though it is off the bottom. When housing construction recovers, you

can be sure the rails will be a lot more busy. In the meantime,

rails still have the leverage to price their revenue to get them

through till volume fully recovers.

To

drive home the point of the strength of the rails, the revenue per

unit increased between 68 to 85% and operating income per unit is up

255% to 1320% for the period 2002 to 2011. Although CSX operating

income per unit increased by 1320%, it was driven by a tremendous

improvement in operating ratio, compared to the rest. Had CSX

started with operating ratio of 80-82%, like the rest, CSX operating

income per unit would have grown at about the same rate as the

others – in the 250-280% range.

Now,

let's do some valuation on Norfolk. Based on estimated per share

earnings of $5.87 for 2012, the price we paid at $73 gives a PE of

12.5x, not an unreasonable value. With patience, this stock is

likely to work out fine in the end. Will volume ever recover to its

previous peak? The question is when. In the meantime, we wait. And

while we wait, the railroads are increasing prices at a clip over

rail inflation. Just recently, CSX posted on its website to

increase export metallurgical coal tariff rates by 4%. But rising rates can be

a double-edged sword, so they cannot be too unreasonable because

rails are still regulated by the Surface Transportation Board which

has the authority to reduce charges deemed “unreasonable” as

railroad operators can only levy charges that cover their operating

costs and a rate of return on assets. And it is common that

customers has frequently voiced their opinions.

To

understand how railroads get to where they are today, we will

provide some color here. Before 1980, railroads were regulated for

93 years and unable to set prices. With the advent of vehicles and

better connectivity of highway, competition was heightened for the

railroads. While railroads were regulated, truckers and waterways

operators were unregulated, and thus operated on a free market basis

which was a huge disadvantage for the railroads. By the 1970s,

railroads was on the brink of collapse. Bankruptcies were common,

earnings were too low to maintain tracks and equipments in good

condition,, and operating costs were rising. As a result, rails

infrastructure were in shambles and service level was atrocious. At

that time, nationalization was even considered. Eventually, it led

to the Staggers Act of 1980 which deregulated the industry.

Importantly, this act allows railroads to set prices that gives them

a chance to compete with truck and barge operators. Consequently,

railroads turned the table and were able to churn out profits that

would motivate them to reinvest in the business. This led to a

cumulative reinvestment of $480 billion since 1980. Today, railroads

infrastructure is healthy and service level is up year to year. This

has not only allowed railroads to prosper but have also contributed

greatly to the advance of the U.S economy. The railroad are

essentially the backbone for facilitating faster and more efficient

movement of goods, provided the proper infrastructure are in place

and are serviceable with a reliable service schedule and level. So

to re-regulate the rail industry would take a brave-heart to do so

unless the industry trips over themselves.

- Celgene

A

very small position bought for 15.5x adjusted 2012 earnings at $73.

Growth rate of 10-15%. Celgene is a biopharmaceutical with a few

commercial drugs manufactured and marketed by them. The main revenue

driver is Revlimid, a drug used for a type of blood cancer, Multiple

Myeloma(MM). In treating MM, there're basically three drugs, 2 of

which belongs to Celgene and the other, a subsidiary of Johnson and Johnson. Revlimid, along with the one by JNJ, are the two first-line

drugs used in treating MM. The other drug that has the potential to

attain blockbuster status in Celgene's fold is Abraxane, currently

only approved as a second-line treatment for metastatic breast

cancer. But there are a number of clinical trials (from early to

late stage) to study extended use of Abraxane in other areas of

oncology, for example, pancreatic. Celgene is hopeful Abraxane will

eventually be a major driver of revenue. However, I made a decision

buying Celgene in a haste. I would be better off had I exercise

patience again. But I still think Celgene provides a good likelihood

that I will be proven right because their existing commercial drugs

are running strong, and the pipeline should also provide some boost

in the future. And perhaps as a form of self-consolation, Celgene's

management is still targeting at least $8 adjusted earnings per

share in 2015. We shall see.

- Singapore and other stocks – M1, Singapore Land and Tesco (small positions)

- Bought M1 at S$2.42 early in the year. Received S$0.079 in the meanwhile as dividend and stock ended June 2012 at $2.56. M1 was bought along with Starhub at the same time, but Starhub has been sold in June 2012 at S$3.28, which appreciated from S$2.72.

- Singapore Land was bought at S$5.65 in Feb 2012 . Highly discounted from book value. Sells for a reasonable 10x cash flow. A majority amount of predictable revenue such as rental and hotel operations which can cushion the impact of the cyclical property development business. Excluding property development income, the predictable segments earns about S$0.50 to S$0.54, about 10.5 to 11x earnings multiple.

- Tesco is the giant UK retailer with international operations in Thailand, Malaysia and other parts of Asia and Europe. Bought Tesco in Jan 2012 at-the-then-3-or-5-year-lows at £3.155 per share or about 9x expected earnings. While we wait for the management to turn the UK retail business around, we get paid over 4% in dividend. Surely, a turnaround in retail is never a sure-thing. Just look at Carrefour, they even cut dividend. But in Tesco, we shall see. I believe fundamentally, they are not as bad as Carrefour. There's a reasonable chance for them. And that's why this is not a huge bet but a small one.

While

on the topic of a huge bet in a single or couple of positions, I have

not had one since late 2008 and early 2009. The last stock with more

than 20% in one position was Pepsico during 2011 but has since been

watered down to get into more favorable positions. Pepsico was

acquired for stability rather than an outright bet on a huge gain.

Now our largest position is in cash.

In

total, we hold 19 different equities – a record number we have ever

held at single time. Our top five positions of equities make up 54%

of all equities value (excluding cash). Our top seven positions

comprise 65% of all equities ex cash. Our seven largest positions are

Berkshire Hathaway, IBM, UOB, Mastercard, Pepsico, Coca Cola, and

Norfolk Southern, in the order of size. None of the positions account

for more than 10% of total assets including cash. However, three of

the positions accounts for more than 10% of equities value when cash

are excluded.

Compared

to where we started off, we had only 5 positions, with the top 2

positions making up 84% of all assets. Today is unlike the days when

we started off where bargains were abound. Some were selling for as

cheap as 20 cents on the dollar - for example, you can buy American

Express at $10 and now $57. If you dig a little more, there were even

10 cents on the dollar - for example, Liberty Interactive which was

available at $2 and now almost $18. The top 2 positions held then

were Wells Fargo and American Express. None of which we hold today.

When the market is in turmoil, it is easier to just concentrate your

positions in a couple of stocks because you don't need to worry on

risk as much as now.

Lastly,

divestures include Anheuser-Busch Inbev, Baxter, St. Jude Medical,

Starhub, CSX Railway, Molson Coors, Amgen, and SIA Engineering. We

only lost money on Molson Coors – a lost of 4.6% from what we pay,

but partially offset by dividends.

Mea-Culpa

Confession X 2

Deja

vu, this one is so reminiscent of what I did to Davita in the last

quarter of 2011. Of all the divestures for 2012, the only one I think

I made a mistake is Anheuser-Busch Inbev because it is a well-managed business with a first class CEO alongside a set of first-class

owners. It is a business that is focused on operational excellence and

provides a good growth rate (at least a high single digit growth). I

wish I know what I was thinking of when we sold BUD.

I

sold BUD at $64.6 early 2012 and regretted almost immediately when I

analyze in details. After that, it surges up. Then I bide for my

time. The stock hit a high of $74 over a month or so and then

gradually decline, and fell to slightly below $67. This is when I

committed a second mistake. Because I sold at $64.6, it became a drag

and anchor to buy again even though at $67, it was selling for 14.5x

2012 earnings, and much less for next. At this valuation, it will

likely provides a decent return. I told myself to buy at $67 but when

it fell below that, I kept thinking about $64.6. Only heaven knows

what I am thinking about. Now, the stock is even further from my

reach – last done at over $79. But well, I do not have to think

about them since the potential upside is pretty much lesser now and

not worth the risk to pursue.

You

can bet this will likely happen again because BUD case is not the

first time it happens. In fact, it is reminiscent to what I did for

Davita late last year. Davita was acquired for $63 in September 2011

and sold for $74 soon. Again, it was a mistake for failure to think

before selling. Then the stock only went up to a point of $90. Then I

bided for time hoping to repurchase again at a better price. About

two months ago, DVA announced a deal to acquired Healthcare Partners

which will be slightly accretive to earnings and purchase for a

reasonable price. The market did not react well to the news and price

fell to $78. At $78, it was selling at about the same multiple as

what I paid for in 2011. But I got anchored by the price I sold

earlier. Unfortunately, the price never came back down to $74. Now it

is over $95, way beyond my reach. Two deals which I clearly made the

same type of mistakes eerily follow a similar path in consequence.

What have I found out? Tying and anchoring yourself to the past and

basing a decision on other than facts is detrimental to one's

financial well-being which I have learnt but hopefully, will

practice.

Finally,

to close the letter, I recommend reading the book – Dethroning the

King: The Hostile Takeover of Anheuser-Busch.

NOTE: All currencies are in USD unless otherwise indicated. Returns are all measured in USD.